Home Equity Line of Credit

A home equity line of credit (HELOC) is a revolving loan. The lender agrees to lend up to a maximum amount within a set period, called the term or draw period. The borrower’s property is used as collateral to secure the loan.

In this comprehensive guide, we will explore various aspects of HELOCs and their tax consequences, helping you navigate the complexities of tax deductions, capital gains, and reassessments.

One of the primary factors in qualifying for a HELOC is having sufficient equity in your home. Let's explore what qualifies or disqualifies you from obtaining a home equity line of credit.

This comprehensive guide dives into what HELOCs are, how they work, their advantages, and potential disadvantages. Whether you're considering renovations, consolidating debt, or funding major life events, a HELOC could be a valuable tool in your financial arsenal.

In this article, we'll explore the essential requirements for obtaining a HELOC in 2024, drawing on insights from leading financial experts and institutions.

In this article, we'll explore the benefits of HELOCs, including low interest rates, and how this can be a strategic financial tool for homeowners.

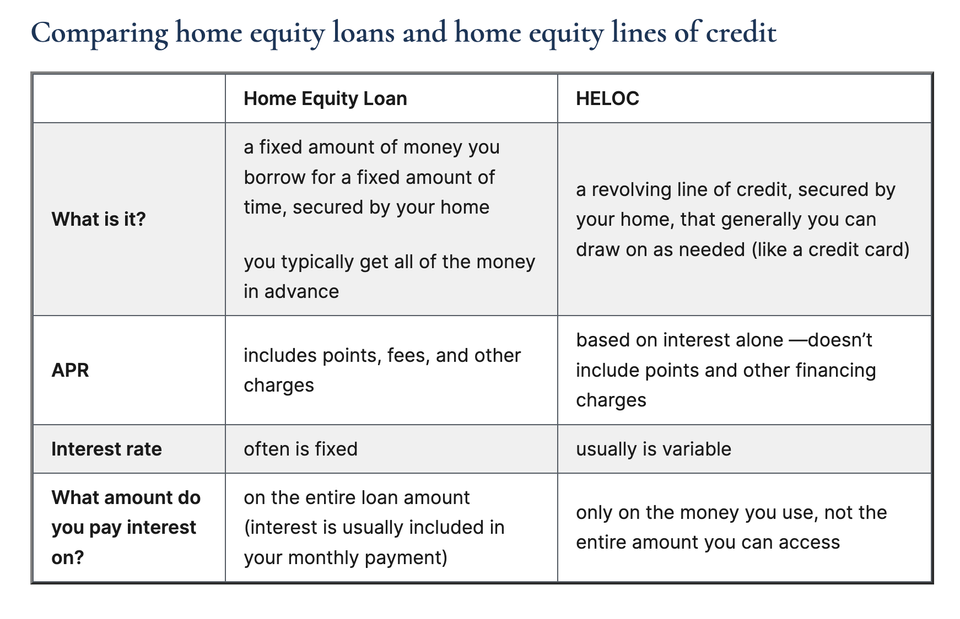

In this article, we'll explore the factors that influence your borrowing capacity, how to calculate potential loan amounts, and the differences between a HELOC and a home equity loan.

This comprehensive guide explains the differences between Home Equity Lines of Credit (HELOCs) and Home Equity Loans, detailing their advantages, disadvantages, and how to determine the best option for leveraging your home equity for financial needs.

This article explores the nuances of using a HELOC for debt consolidation, drawing insights from various financial experts and institutions.