Determine your home’s REAL appraisal and ensure that valuations are conducted fairly and accurately.

Tennant Lending

Tennant lending is a real estate education center. Our mission is helping families grow wealth by facilitating real estate ownership throughout the country.

Read Our Latest Posts

Latest Posts

The Federal Housing Finance Agency (FHFA) recently released its 2024 Q2 update, shedding light on the current state of single-family and condominium appraisals across the United States.

The FHFA's 2024 policy updates mark significant changes in the real estate financing landscape. With more predictable pricing, lenders can adjust their strategies accordingly, potentially passing on cost savings to borrowers.

Determine your home’s REAL appraisal and ensure that valuations are conducted fairly and accurately.

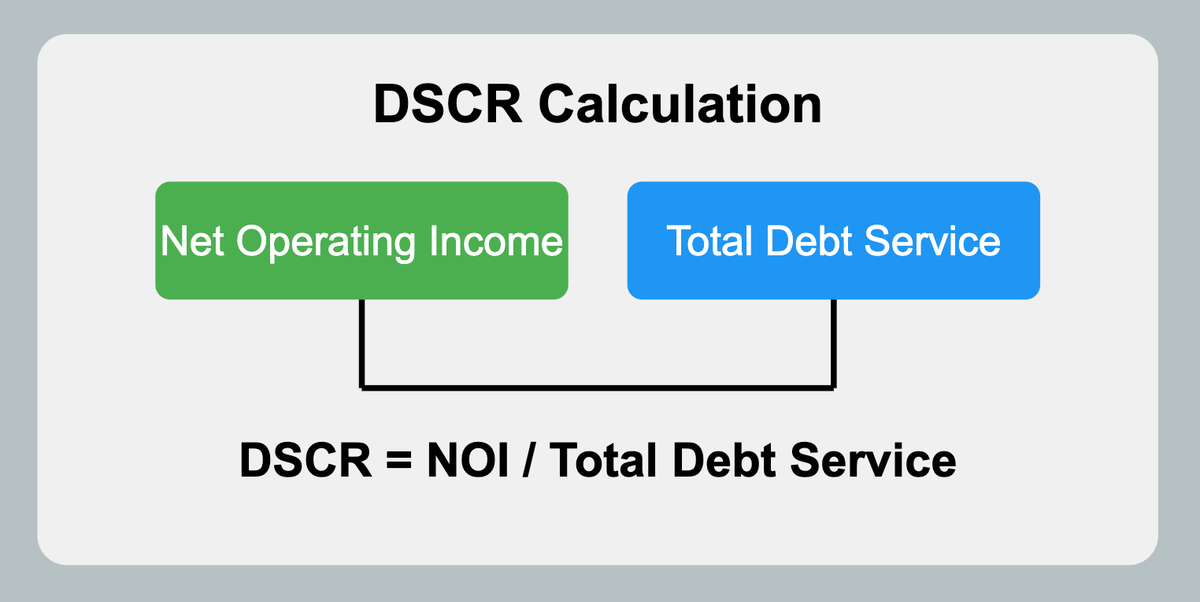

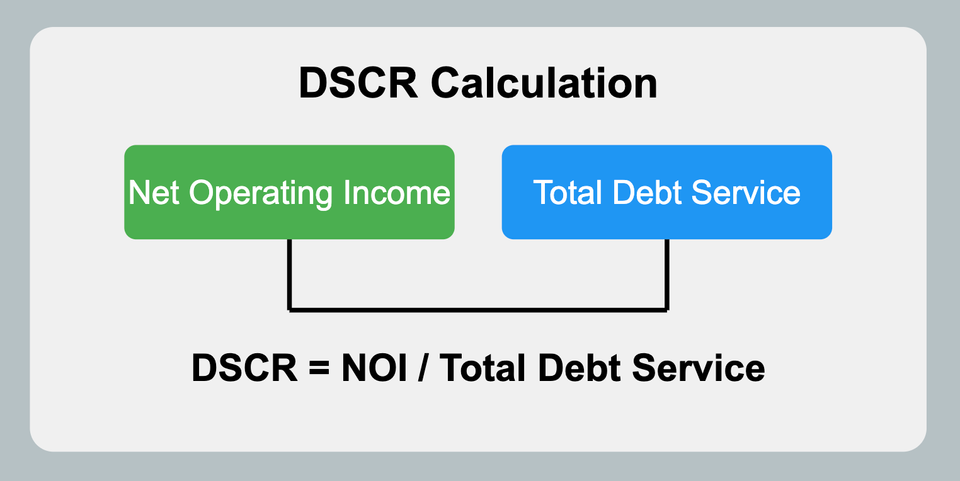

By mastering the intricacies of DSCR loans, savvy investors can leverage this tool to build robust, scalable real estate portfolios that generate steady cash flow and long-term wealth.

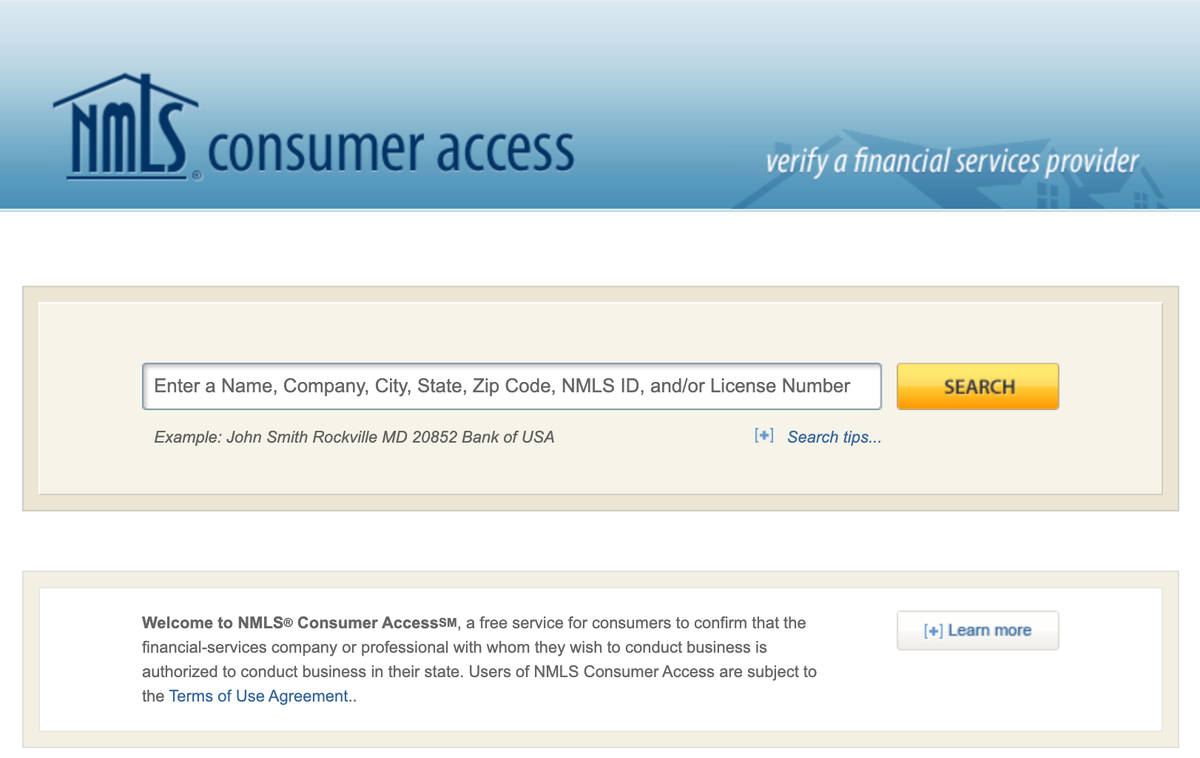

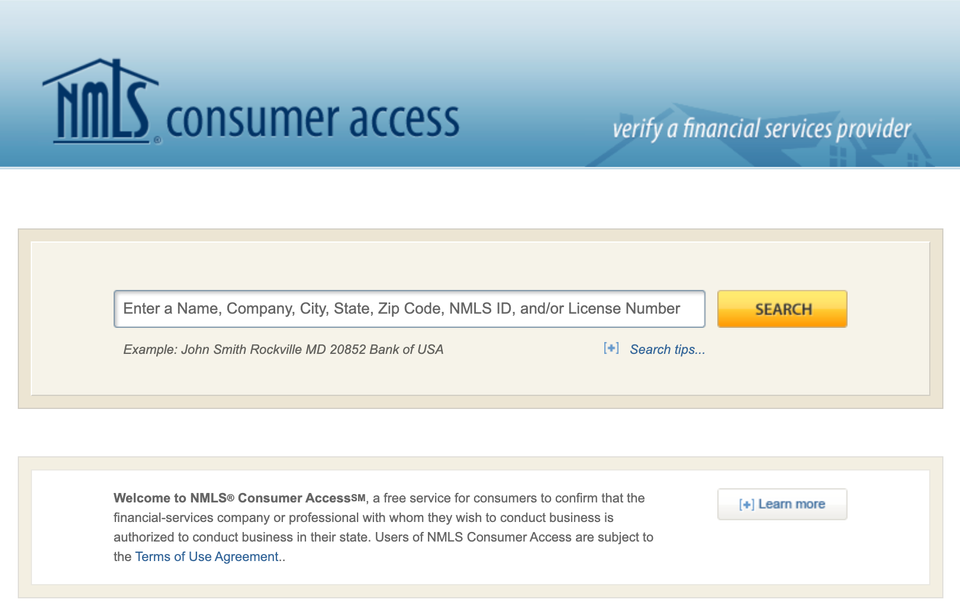

NMLS Consumer Access is a public website that lets you verify the licensing and registration of mortgage professionals. Learn how to use it to ensure you're working with trustworthy lenders.

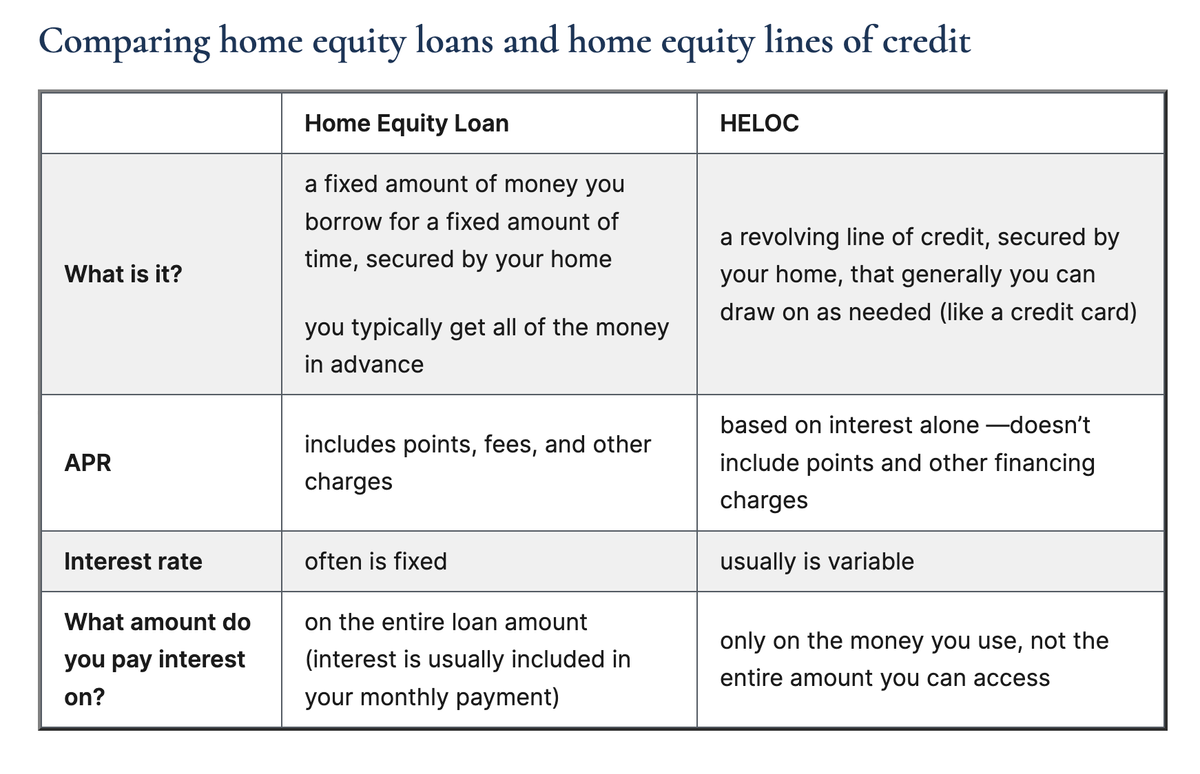

Discover the ins and outs of cash out refinancing, a strategy that lets homeowners tap into their home equity for cash, covering its definition, benefits, drawbacks, eligibility, application process, tax implications, and comparisons with other financial options.

Explore the pros and cons of cash-out refinancing, a strategy that allows homeowners to leverage their home equity for cash, through this comprehensive guide that provides detailed insights to help you make an informed financial decision.

Learn how to effectively leverage cash-out refinancing to access home equity for long-term financial goals, including home improvements, debt consolidation, education funding, emergency funds, real estate investments, and business growth.